Welcome to Your Medicare Resource Center

At our Medicare Resource Center, we strive to provide you with comprehensive information about the various aspects of Medicare. Our goal is to empower you with the knowledge you need to make informed decisions about your healthcare coverage. Explore the sections below to better understand the different parts of Medicare, learn about enrollment options, and access helpful tools.

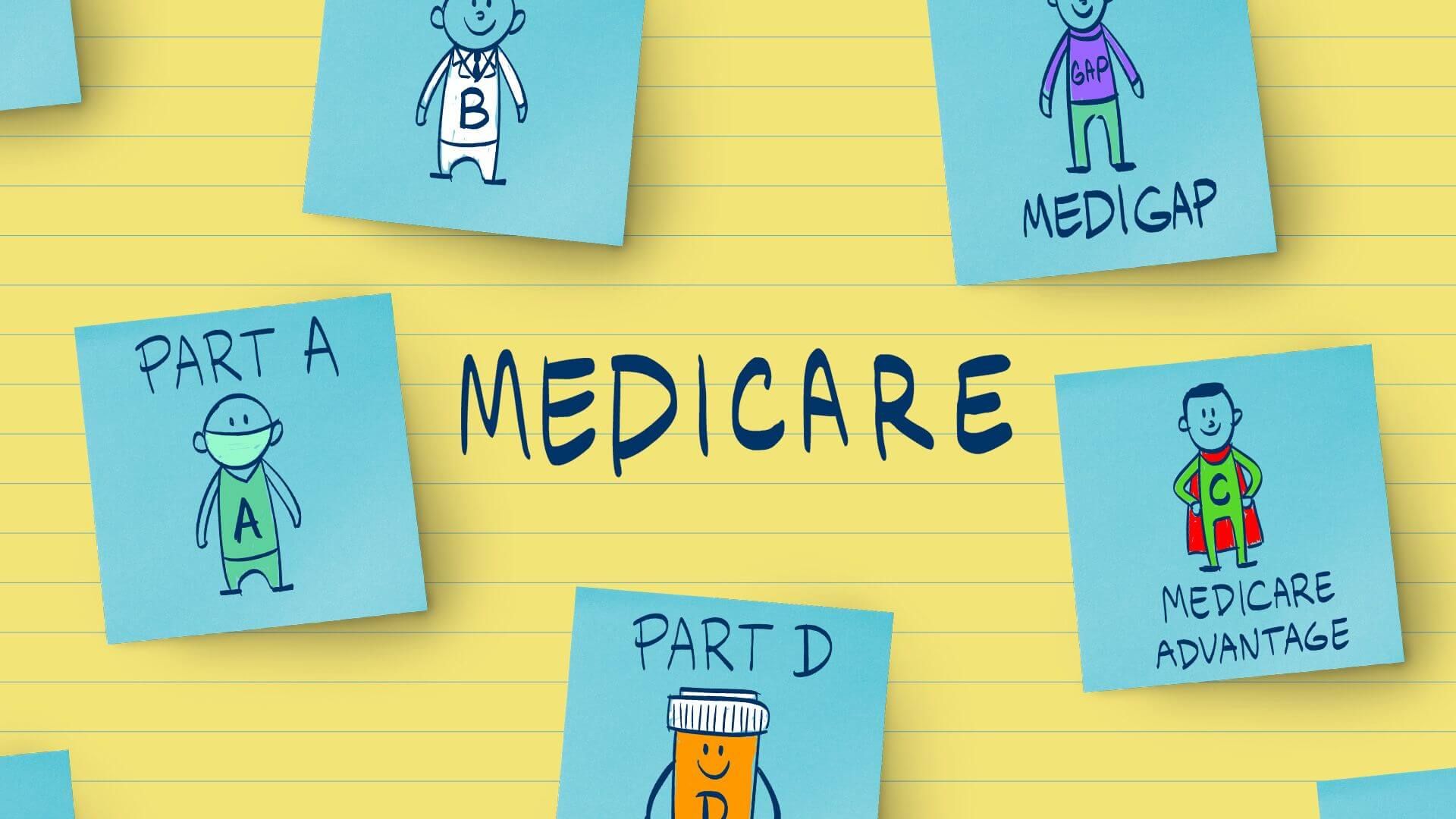

Understand the Four Parts of Medicare

Gain insight into the four essential components of Medicare: Part A, Part B, Part C, and Part D. Each part plays a crucial role in providing comprehensive healthcare coverage.

Part A

Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

Part B

Covers outpatient care, doctor visits, preventive services, and some home health care.

Part C

A private insurance plan that combines coverage from Part A, Part B, and often Part D (prescription drug coverage)

Part D

Provides prescription drug coverage through private insurance plans approved by Medicare.

Understanding My Medicare Options

Explore the diverse range of Medicare options available to you. Whether you’re considering Original Medicare or Medicare Advantage, we provide the information you need to make the right choice for your healthcare needs.

Option #1 – Medicare Supplement Insurance Plans (aka Medigap)

A Medicare Supplement Insurance Plans is used with original Medicare. Any caregiver that accepts Medicare will take a Supplement because they only need to bill Medicare. Medicare pays their part (generally 80% of Medicare covered benefits) and sends the remainder of the bill to the Supplement which pays their part (generally 20%). It is important to note that Supplements do NOT include Prescription Drug Coverage (Part D, PDP) and for those that do not get a PDP when first eligible there will be a penalty when they do get a PDP. (there are exceptions to this) A Medicare Supplement does not change year to year (although the cost does generally go up the coverage does not change).

Option #2 – Medicare Advantage Plans (aka Medicare Part C)

A Medicare Advantage plan works differently than a Supplement. With a Medicare Advantage Plan a private company TAKES OVER for Medicare (you remain in the Medicare system but Medicare is no longer responsible for your bills). These plans follow the same type of module as many group plans such as HMO or PPO. With this type of plan it is important to remember several things.

First, most Advantage Plans have Networks so you want to make sure your Doctor, Hospital, and auxiliary care are within the network. (otherwise you will be paying higher costs and in some cases are responsible for 100% of care outside the network)

Second, Advantage Plans have co-pays associated with them. It is important to be aware of these because they can add up to be quite a bit of money. Third, most Advantage Plans have the Part D “built in” which is a nice bonus but you must be aware that when switching to a Supplement from an Advantage Plan you will also need to add a Part D. (there are several types of Advantage Plans that do NOT have the Part D built in so this is something you need to keep in mind when choosing any plan).

Lastly, Advantage Plans typically have value added benefits. These benefits vary between plans but typical benefits include Health Club membership, limited dental, eye and/or vision.

Also, not all Plan D’s are the same. Although they are required to be at least as good as the Medicare model they can vary greatly in costs, co pays and specific drugs that are covered. It is important to check which one suits you and continue to check each year because they (like Advantage Plans) do change every year.

Because these plans vary even from county to county, we strongly recommend that you talk to an independent insurance agent to help you choose the one that best suits your needs.

Medicare offers prescription drug coverage to everyone with Medicare. If you decide not to join a Medicare Prescription Drug Plan when you’re first eligible, and you don’t have other creditable prescription drug coverage, or you don’t get Extra Help, you’ll likely pay a late enrollment penalty. To get Medicare drug coverage, you must join a plan run by an insurance company or other private company approved by Medicare. Each plan can vary in cost and drugs covered.

Feel free to explore each section to enhance your understanding of Medicare and make informed decisions about your healthcare coverage. If you have any questions, our team is here to assist you. Your health and well-being are our top priorities.